Market Report | March 2023

REGO

- After dips in Prices, CP21 REGOs regained most of their losses to settle in the low/mid £5s/REGO for Biomass and mid £6s for Non-Bio.

- Prices for CP22 production have increased to about £9/REGO, with sellers holding back in anticipation of what the new Compliance Period will bring.

- Generators buying EU GoOs for their fuel mix disclosure and selling their REGOs at a profit will now have to keep their REGOs, further limiting supply.

- At the current CP22 pricing and given the volatile nature of the REGO market, it might be a good idea to lock in at least a portion of CP22 output at current prices.

“A quiet month on the REGOs as Utilities calculate their REGO needs for the end of CP21 and sellers wait until April to claim their final REGOs.”

Mike Ridler, Head of Green Markets at C-Zero

“Lots of waste volumes are being offered on the market; now might be the time for sellers to lock in 2023 production volumes.“

RGGO

- Waste pricing has begun to come off slightly as more volumes are being offered on the market due to the lack of Swedish demand for certificates after the EU ruling (see last month’s report)

- ISCC Waste Certs are still commanding high price levels, but recent bids in the low £50s have been withdrawn, and buyers are now aiming for the mid £40s

- Crop price increases have slowed, probably due to the fall in waste, but crop is still in demand.

- Guidance from the World Resources Institute (WRI), administrator of the GHG Protocol, on their proposed changes regarding Green gas certs is eagerly anticipated.

- Over 50 biogas and biomethane trade associations and companies worldwide have called on the WRI to rethink its position on using biomethane certificates for greenhouse gas reporting by corporate gas users. They are asking for the removal of Annex B of the guidance and for the reinstatement of the existing guidance allowing companies to purchase biomethane certificates as part of their Scope 1 reporting.

“RTFCs have taken a beating on price, but maybe there’s a rebound coming.”

Bruce Brown

Head of Client Partnership at C-Zero

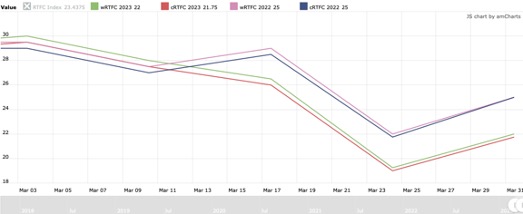

RTFC market lacking liquidity and trades

- Prices dipped drastically by over 30% in the month from 30p to below 20p. There’s been a slight rebound in the last few days but still considerably lower than earlier in the year.

- Biodiesel prices have tanked over the last month, with the supply of raw materials and finished products far outstripping demand, causing severe downward pressure. However, with prices so low, there has been a slight uptick towards the month-end in buying interest, which has caused a pricing uptick.

- RTFC for waste-fed biomethane at current prices worth just over 6p/KWh for 2023 certificates

- One reason to be cheerful is the announcement of a UK consultation into increasing the use of Sustainable Aviation Fuel (SAF), meaning that stated targets would hoover up all available feedstock creating a tightness in the market, which can only be suitable for RTFC prices in the medium termReason number two is that HVO production and usage have recorded substantial numbers in the latest figures showing that adoption of the fuels is increasing; again, this should underpin market drivers.