Market Report | January 2024

REGO

- The REGO market is picking up as suppliers have a clearer view of their CP22 position.

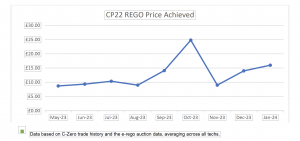

- The chart below details CP22’s pricing history since April 23.

- REGOs are now achieving prices around the mid-teens across all technologies.

- Prices are up 88% from November, when there was poor liquidity, and up 15% from December, indicating a generally upward trend.

- That said, the overall picture remains one of volatility, with uncertainty over pricing as we head towards the end of the Compliance Period.

“REGO market looks to be on an upward trend – for now.”

Clare Haigh, Head of Environmental Markets at C-Zero

” RGGO prices are still in a slow decline as European demand dries up. “

Clare Haigh, Head of Environmental Markets at C-Zero

RGGO

- A lack of buyer demand continues to pressure biomethane, with persistently low buying interest weakening prices.

- Waste certificate prices continue to decline to the £14/£16 mark.

- There is currently little interest in crop certificates, although very low volumes have sold at £11/MWh.

- There is a wide bid/offer spread, with buyers holding off as prices decrease and producers unwilling to sell at that level. It is unclear at what level buyers will be incentivised to purchase.

- The sentiment from European traders is that we are yet to see the floor price.

- Some generators are looking at multi-year offtake contracts at a slight premium to current market levels. Given recent market volatility, this could serve as a hedge for producers looking for price certainty for some of their forward volumes.

- As a result of the EU’s implementation of 2022/966 and ISCC methodology changes, producers are required to calculate the greenhouse gas emissions based on their combined feedstocks rather than a split. This is resulting in a temporary pause in new contracts.