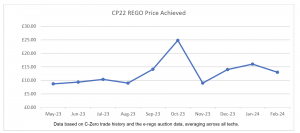

Market Report | February 2024

“REGO prices look to be drifting downwards.”

Clare Haigh, Head of Environmental Markets at C-Zero

“RGGO prices continue to decline as demand dries up.“

Clare Haigh, Head of Environmental Markets at C-Zero

RGGO

- A lack of buyer demand continues to pressure biomethane, with persistently low buying interest weakening prices.

-

For 2023, production – waste certificate continue their decline to around the £9 mark and crop to circa £5

-

For 2024 production, waste certificate prices are around the £11-12 mark, and crop prices are circa £7.

-

The UK RGGO market has drifted downwards since the beginning of 2023. We believe several factors have contributed to this price decline

- The EU ruled that Sweden could not offer a generous tax break to imports of Biogas since it had already been subsidised in the country of production. This slowed the transfer of RGGOs from the UK to Europe as there was a glut of Danish, Dutch, and German certificates that had previously entered the Swedish market.

- BMP (a German Biogas trader and producer) was one of the biggest buyers of UK RGGOs in 2022. In mid-2023, special administrative measures were taken, and RGGO purchasing was halted.

- Sentiment has been further dented by the ISCC changing the rules on measuring Biogas’s Carbon Intensity (CI), i.e., moving to a plant average across all feedstocks rather than a CI score for each feedstock.

- An influx of biofuels from China has dampened demand for Biogas as a transport fuel, and the EU plans to implement a “Union Database” to track the sustainability criteria of the EU.